India–Oman CEPA : What the New Trade Deal Means for Exports, Services and Jobs

Key Takeaways

- The India–Oman CEPA provides a comprehensive framework covering trade in goods and services, investment, professional mobility, and regulatory cooperation.

- Bilateral trade stood at USD 10.61 billion in FY 2024–25, reflecting the expanding scale of India–Oman economic engagement.

- India secures 100% duty-free market access in Oman across 98.08% of tariff lines, covering 99.38% of export value, with benefits effective from Day One.

- The agreement opens export opportunities across engineering goods, pharmaceuticals, agriculture and processed food, marine products, textiles, chemicals, electronics, plastics, and gems & jewellery.

- A calibrated liberalisation approach, including an exclusion list, protects sensitive sectors while supporting MSMEs, labour-intensive industries, and region-wide export growth.

-A PIB FEATURE-

A wide-ranging pact between countries that goes beyond goods trade to cover services, investment, government procurement, dispute settlement, and other regulatory aspects. It also incorporates mutual recognition agreements, acknowledging differing regulatory regimes of partner countries on the basis that they achieve equivalent outcomes. The Comprehensive Economic Partnership Agreement (CEPA) between India and Oman marks a meaningful step forward in the economic relationship between the two countries. The agreement brings together trade in goods and services, investment, professional mobility, and regulatory cooperation under a single, coherent framework aimed at deepening bilateral economic integration.

Rather than focusing on a single sector or tariff reduction, the CEPA is designed to support steady and long-term economic engagement. By facilitating trade, promoting investment, and strengthening cooperation in sectors of mutual interest, the agreement seeks to unlock new opportunities for labor-intensive sectors, services, and emerging areas of cooperation. At the same time, it maintains a balanced and calibrated approach to market access, while providing clearer rules, wider market access, and greater predictability for businesses and investors in both countries, without compromising domestic priorities and safeguards.

India–Oman Economic Engagement

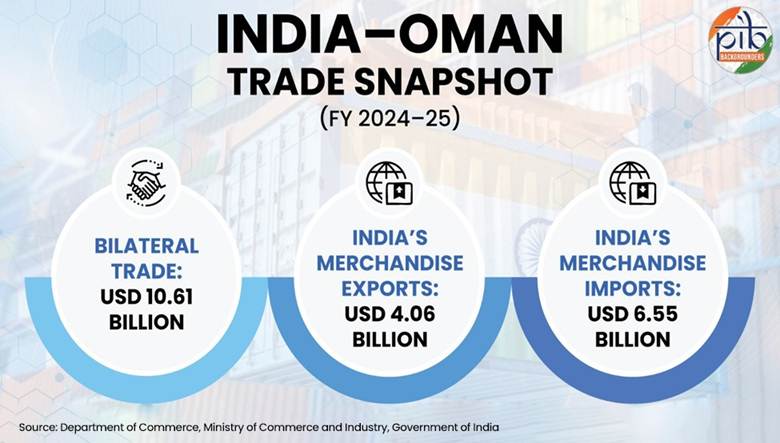

Trade and commerce have been a key pillar of bilateral cooperation between India and Oman, with both sides recognizing the potential for further growth and diversification in bilateral trade. During FY 2024–25, bilateral trade between the two countries stood at USD 10.61 billion, compared to USD 8.94 billion in FY 2023–24. Trade during the period April–October 2025 stood at USD 6.48 billion.

Merchandise Trade

- India’s exports to Oman were valued at USD 4.06 billion in FY 2024–25. During April–October 2025, exports stood at USD 2.57 billion, registering a growth of around 5 per cent.

- Imports from Oman amounted to USD 6.55 billion in FY 2024–25, while imports during April–October 2025 stood at USD 3.91 billion.

Services trade

- India’s exports to Oman increased from USD 397 million in 2020 to USD 617 million in 2023, led by telecommunications, computer and information services, other business services, transport, and travel services.

- Imports from Oman rose from USD 101 million to USD 159 million, with key sectors including transport, travel, telecom services, and other business services

This expanding engagement in goods and services provided a strong basis for the decision to pursue a comprehensive economic partnership agreement.

Market Access in Goods: India’s Gains

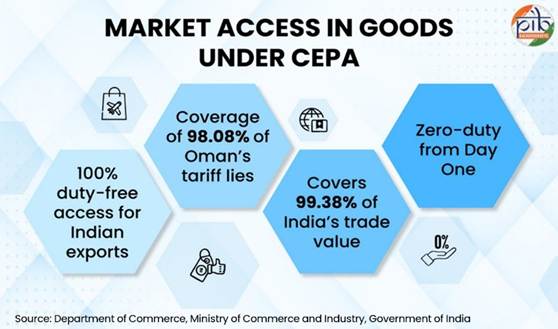

Under the CEPA, India secures 100 per cent duty-free market access for its exports to Oman, covering 98.08 per cent of Oman’s tariff lines and accounting for 99.38 per cent of India’s trade value, based on the average for 2022–23. All zero-duty concessions apply from the first day of the agreement’s entry into force, providing immediate certainty to exporters.

Presently, only 15.33 per cent of India’s export value and 11.34 per cent of tariff lines (2022–24 average) enters the Omani market at zero duty under the MFN (Most Favored Nation) regime. With CEPA, Indian exports to Oman that earlier faced duties of up to 5 per cent, valued at around USD 3.64 billion, are expected to gain significantly from improved price competitiveness.

| The agreement opens export opportunities across a wide range of sectors, including minerals, chemicals, base metals, machinery, plastics and rubber, transport and automotive products, instruments and clocks, glass, ceramics, marble, paper, textiles, agricultural and processed food products, marine products, and gems and jewellery and many more. |

With enhanced access to Oman’s import market of over USD 28 billion, supported by streamlined regulatory procedures, reduced compliance requirements, and faster market entry, Indian exporters are well positioned to expand their presence across multiple product segments.

India’s Market Access Offer and Safeguards

| The exclusion list includes all items on which no tariff has been offered by the countries, under the CEPA. |

India has offered tariff liberalization on 77.79 per cent of its total tariff lines (12,556), covering 94.81 per cent of India’s imports from Oman by value. At the same time, India has placed multiple tariff lines in the exclusion list. This move intends to protect key domestic sectors and sensitive value-chain industries and also safeguard manufacturing competitiveness and farmer interests.

| Key Domestic Sectors such as transport equipment, major chemicals, cereals, spices, coffee and tea, and animal-origin products.

Sensitive value-chain industries including rubber, leather, textiles, footwear, petroleum oils, and mineral-based products.

Key Agricultural products such as dairy, oilseeds, edible oils, honey, , fruits and vegetables. |

Sectoral Impact of the CEPA

Engineering Goods

Oman is an important destination for India’s engineering exports, which reached USD 875.83 million in FY 2024–25, covering machinery, electrical equipment, automobiles, iron and steel, and non-ferrous metals.

- Under the CEPA, all engineering products receive zero-duty market access, replacing earlier MFN tariffs of 0–5 per cent and improving price competitiveness for Indian exporters.

- With tariff elimination and improved market access, engineering exports to Oman are projected to rise to USD 1.3–1.6 billion by 2030, helping restore growth momentum.

- Key gains are expected in iron and steel products used in infrastructure projects, electric and industrial machinery supporting Oman’s diversification, motor vehicles following removal of the 5 per cent tariff, and copper products for electrical and construction uses.

- The agreement is expected to benefit MSMEs, particularly in iron and steel and machinery segments, by enabling scale-up and deeper integration into Oman’s industrial and infrastructure supply chains.

- Tariff elimination across vehicles, auto components, and industrial equipment also supports demand from sectors such as construction, logistics, food processing, textiles, and chemicals.

At a broader level, Oman offers Indian engineering exporters a stable alternative market and strategic diversification amid rising global protectionism in markets such as US, EU and Mexico, while supporting wider access to the GCC and the Middle East.

Pharmaceuticals

Oman’s pharmaceutical market was valued at USD 302.84 million in 2024 and is projected to reach USD 473.71 million by 2031, growing at a CAGR of 6.6 per cent. The market remains heavily import-dependent, creating sustained demand for external suppliers.

- Under the CEPA, binding zero-duty access is provided for key finished medicines, vaccines boosting competitiveness in public private procurement, and core active pharmaceutical ingredients, including penicillins, streptomycins, tetracyclines, and erythromycins, supporting stable pricing and long-term supply arrangements.

- The agreement introduces regulatory fast-tracking for pharmaceutical products approved by recognized stringent authorities such as USFDA, EMA, UK MHRA, and TGA, with eligibility for 90-day marketing authorizations without prior inspections, subject to submission of complete assessment dossiers. In cases where inspections are required, approvals are targeted within 270 working days.

- Acceptance of GMP (Good Manufacturing Practices) certificates & inspection outcomes, streamlined stability requirements maintaining quality & safety standards, and pricing aligned with local market conditions and public health priorities together reduce compliance costs and approval timelines, while supporting affordability and sustainable supply in the Omani market.

Marine Products

Oman’s imports of marine products stood at USD 118.91 million during 2022–24, while imports from India were USD 7.75 million, indicating considerable scope for export expansion. The CEPA is expected to support higher exports of Indian seafood products such as shrimp and fish to Oman.

- Under the CEPA, marine products receive immediate duty-free access, replacing earlier import duties of 0 to 5 per cent and delivering instant price competitiveness for Indian exporters.

- Given the labour-intensive nature of the marine sector, expanded market access holds potential for employment generation, particularly in coastal regions and associated processing activities.

Product-level data highlights untapped potential in key categories. India’s exports of Vannamei shrimp to Oman were USD 0.68 million in 2024, compared to India’s global exports of USD 3.63 billion, while exports of frozen cuttlefish to Oman stood at USD 0.36 million, against global exports of USD 270.73 million.

Agriculture and Processed Food

Oman’s agricultural imports increased from USD 4.51 billion in 2020 to USD 5.97 billion in 2024, recording a CAGR of 7.29 per cent. In 2024, India held a 10.24 per cent share of Oman’s agricultural imports, ranking as the second-largest supplier. During the same period, India’s agricultural exports to Oman rose from USD 364.67 million to USD 556.34 million, registering a strong CAGR of 11.14 per cent.

Exports of APEDA-scheduled products grew from USD 299.49 million to USD 477.33 million, reflecting a CAGR of 12.36 per cent. Major export items include basmati and parboiled rice, bananas, potatoes, onions, soybean meal, sweet biscuits, cashew kernels, mixed condiments, butter, fish body oil, prawn and shrimp feed, frozen boneless bovine meat, and fertilized eggs.

| Key Gains in Agricultural Products

Boneless meat of bovine animals – Duty-free access reinforces India’s dominant supplier position, with a 94.3% share in Oman’s USD 68.27 million import market.

Fresh eggs – Zero-duty access consolidates India’s 98.3% share, making Oman India’s largest export destination for eggs.

Sweet biscuits – Duty-free entry strengthens India’s position in Oman’s USD 8.05 million biscuits market, improving competitiveness against Turkey, UAE and Saudi Arabia.

Butter – Elimination of the 5% tariff improves India’s price competitiveness in Oman for exports valued at USD 5.75 million, giving India an edge over Denmark, Saudi Arabia and New Zealand.

Natural honey – Tariff elimination improves India’s price competitiveness in Oman’s USD 6.61 million honey market, where India holds a 19.2% share, giving India an edge over Australia, China and Saudi Arabia.

Mixed condiments & seasonings – Duty-free access strengthens India’s 14.1% share in Oman’s USD 40.02 million market, placing India at par with the USA and ahead of Saudi Arabia and the UAE. |

At the same time, India has adopted a calibrated safeguard approach to protect domestic farmers and sensitive agricultural interests. Major products such as dairy items, cereals, fruits, vegetables, edible oils, oilseeds, and natural honey have been excluded from immediate tariff concessions.

| Phased tariff elimination over five to ten years

For Selected processed products, such as sweet biscuits, rusks, toasted bread, pastry and cakes, papad, dog or cat food. This supports export growth while safeguarding food security and domestic agricultural interests. |

Electronics

Oman imported electronic goods worth USD 3 billion in 2024, while India’s exports stood at USD 123 million, indicating clear scope for expansion. Key import segments include smartphones, photovoltaic cells, telecom instruments and parts, boards and cabinets for electric control or distribution, and static converters.

India already exports smartphones, static converters, and boards and cabinets, with a relatively stronger presence in the latter two. Import duties are already zero for most electronics, and under the CEPA, remaining items—boards and cabinets, static converters, and television reception apparatus—also move to zero duty, improving tariff certainty. With the top ten products accounting for an Omani market of around USD 2 billion, Indian exporters are positioned to gradually increase market share in selected high-potential segments.

Chemicals

Oman imported USD 3.13 billion worth of chemicals in 2024, while India’s exports stood at USD 169.41 million, indicating significant scope for expansion.

- Under the CEPA, immediate zero-duty access is provided for key chemical categories, including inorganic chemicals, organic chemicals, and chemical products, removing the earlier 5 per cent tariff and improving margins and certainty for Indian exporters.

- Duty reductions of up to 5 per cent apply to chemicals, covering dyes, tanning extracts, soaps and surface-active agents, essential oils, and other industrial preparations, giving Indian suppliers a price advantage over non-FTA competitors.

- The agreement supports closer industrial cooperation as Oman offers opportunities for secure feedstock access, industrial co-location, and green inputs, positioning both countries for longer-term collaboration in petrochemicals, green hydrogen, and value chains linked to Gulf and Africa markets.

Given India’s global chemical exports of USD 40.48 billion, even a modest increase in exports to Oman can yield meaningful gains, particularly for SMEs.

Textiles

Oman’s textile imports stood at USD 597.9 million in 2024, while India’s textile exports reached USD 131.8 million, giving India a 22 per cent share, a sharp increase from 9.3 per cent in 2023.

- Under the CEPA, Indian textile and apparel products that earlier faced import duties of around 5 per cent now receive zero-duty market access, directly improving price competitiveness and supporting higher export volumes.

- Key segments positioned for growth include readymade garments (USD 87.0 million), made-ups (USD 17.4 million), MMF textiles (USD 11.2 million), and jute products (USD 7.3 million).

- Duty-free access strengthens India’s competitive position against major suppliers such as China, Bangladesh, Türkiye, and the UAE, particularly in labour-intensive segments like ready-made garments, home textiles, carpets, jute, and silk products.

Rising textile exports are expected to support production and employment across major Indian textile clusters, including Tirupur, Surat, Ludhiana, Panipat, Coimbatore, Karur, Bhadohi, Moradabad, Jaipur, and Ahmedabad. Improved access to Oman also allows Indian exporters to use the country as a gateway to GCC and East African markets, supported by logistics hubs such as Sohar, Duqm, and Salalah.

Plastics

India’s global plastics exports reached USD 8.11 billion in 2024, reflecting strong production capacity and export readiness. Zero-duty access under the CEPA provides Indian suppliers a clear price advantage of up to 5 per cent over non-FTA competitors.

- Under the CEPA, plastics and plastic articles receive immediate duty-free access, replacing the earlier 5 per cent import duty and improving price competitiveness for Indian exporters.

- Given that India’s plastics sector is largely MSME-driven, improved access to the Omani market is expected to support inclusive export growth and strengthen employment-intensive manufacturing clusters.

Oman’s plastics imports stood at USD 1.06 billion in 2024, while imports from India were USD 89.39 million, indicating substantial scope for untapped export expansion.

Gems & Jewellery

India is a major global player in this sector, with annual exports exceeding USD 29 billion, while Oman imports around USD 1.07 billion worth of gems and jewellery annually, indicating substantial untapped potential. India’s gems and jewellery exports to Oman stood at USD 35 million in 2024, comprising USD 24.4 million in polished natural diamonds and USD 10 million in gold jewellery.

- With duty-free access, the agreement is expected to open further opportunities in the Omani market, particularly for cut and polished diamonds, gold and silver jewellery, and emerging segments such as platinum and imitation jewellery.

- Import duties of up to 5 per cent have been eliminated on all Indian gems and jewellery products, significantly improving market access and price competitiveness for Indian exporters.

- Improved market access is also expected to support employment generation across India’s jewellery-making clusters, including those in West Bengal, Tamil Nadu, Maharashtra, Rajasthan, and Gujarat, reflecting the sector’s strong linkage with skilled and labour-intensive production.

Industry estimates indicate that exports could grow by up to USD 150 million over the next three years, as Indian products gain a competitive edge over suppliers from countries such as Italy, Turkiye, Thailand, and China, which continue to face tariffs.

Services, Investment and Professional Mobility

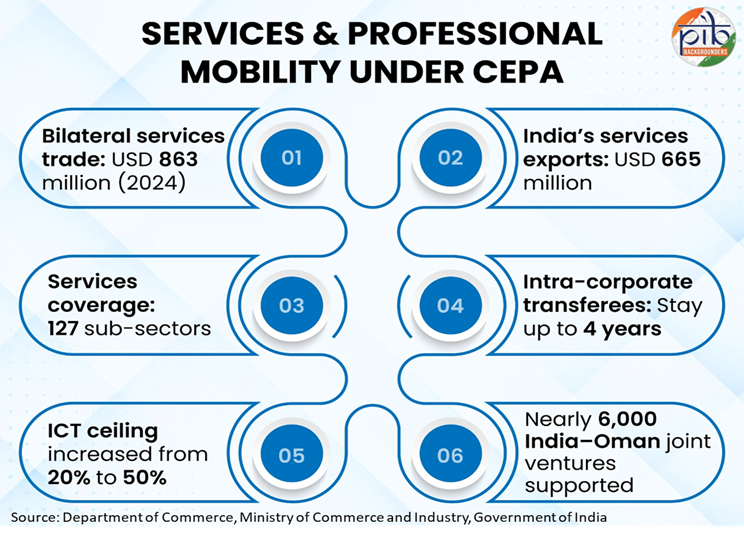

Services are a key pillar of the India–Oman CEPA. In 2024, bilateral services trade stood at USD 863 million, with exports of USD 665 million and imports of USD 198 million, resulting in a surplus of USD 447 million for India. Oman’s global services imports of USD 12.52 billion, with India accounting for 5.31 per cent, indicate significant untapped potential for Indian service providers.

| Under the CEPA, Oman has undertaken broad and deep market access commitments across 127 services sub-sectors, representing GATS/Best FTA-plus commitments. These cover key sectors of export interest to India, including professional services (legal, accounting, engineering, medical and allied services), computer and related services, audio-visual services, business services and R&D, education, environmental services, health, and tourism and travel related services. |

| Intra-Corporate Transferees are employees of MNCs who are temporarily moved from their home country to a branch, affiliate, or subsidiary within another country for a specific role. |

The ICT (Intra-Corporate Transferees) ceiling has been raised from 20 per cent to 50 per cent, enabling Indian companies to deploy more managerial and specialist staff. For the first time under any FTA, Oman has also undertaken commitments for a defined category of professionals, including those in accounting, engineering, medical, IT, education, construction, and consulting services. .

Other Key Gains in Services

| Annex on health and traditional medicine services | Cooperation on licensing and qualifications, digital licensing exams, medical value travel, capacity building, standards harmonization, and joint research in traditional medicine |

| First-of-its-kind provision on mobility in Manufacturing and other Non-Services sectors | Offers binding assurances for Indian industrial workers, supporting investments and joint ventures amid Omanisation through greater predictability and legal clarity. |

| Future negotiations on Social Security Agreement (SSA), | Provides reciprocal continuity of social security benefits and avoids dual contributions for Indian workers and employers. |

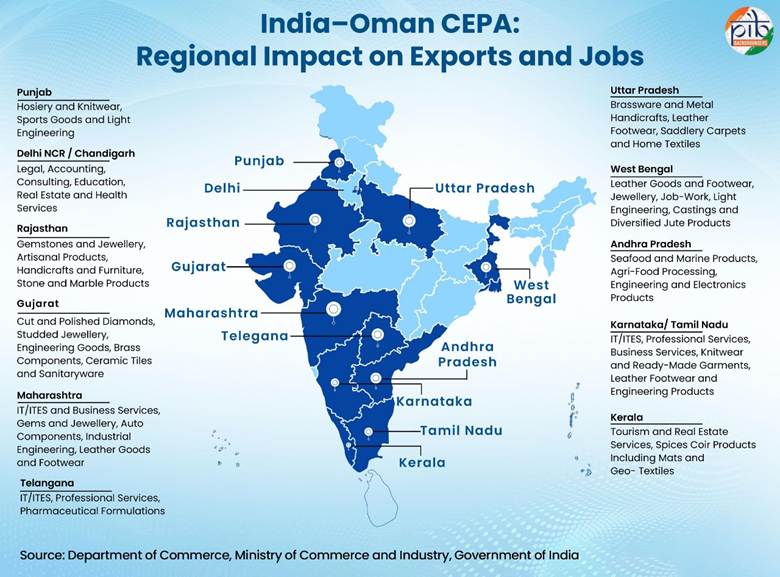

State and Region-Wise Export and Employment Gains

The CEPA is expected to generate broad-based export and employment gains across multiple Indian states, reflecting the geographically diverse structure of India’s export economy.

| Key Agricultural Gains by State | |

| Products | State |

| Meat | UP, Punjab, Haryana, Andhra Pradesh, Maharashtra, Bihar |

| Eggs | Tamil Nadu, Andhra Pradesh, Telangana, Maharashtra |

| Sweet Biscuits | Andhra Pradesh, Telangana, Punjab, Uttar Pradesh |

| Butter | Gujarat, Uttar Pradesh, Maharashtra, Punjab |

| Sugar Confectionery | Karnataka, UP, Maharashtra |

| Potatoes, Prepared/Preserved | Gujarat, Uttar Pradesh, West Bengal, Punjab, Maharashtra |

| Honey | Punjab, Haryana, UP, , West Bengal, Rajasthan, North Eastern Region |

Gains for Labour-Intensive Sectors

The CEPA delivers significant benefits for labour-intensive sectors such as textiles and apparel, leather and footwear, food processing, marine products, gems and jewellery, and select engineering segments. These sectors have strong employment linkages and together support a large workforce across India.

| With near-universal zero-duty market access, Indian exports gain improved price competitiveness in the Omani market, supporting higher demand in labour-intensive industries.

As many of these sectors are predominantly MSME-driven, preferential access under the CEPA helps level the playing field against competitors from Asia and the GCC, enabling scale-up, better capacity utilisation, and export-led growth.

Higher exports in these sectors are expected to translate into employment generation and income support across major production clusters, particularly in textiles, food processing, leather goods, marine products, and light manufacturing.

By encouraging exports of processed and value-added products, the CEPA also supports inclusive growth and strengthens India’s participation in regional supply chains. |

Provisions for Regulatory Cooperation

| TBT Agreement aims to ensure that technical regulations, standards, and conformity assessment procedures are non-discriminatory and do not create unnecessary obstacles to trade.

SPS Agreement concerns the application of food safety and animal and plant health regulations. |

The CEPA contains dedicated provisions on Technical Barriers to Trade (TBT) and Sanitary and Phytosanitary (SPS) measures (explain the meaning of these barriers), which provide a framework for cooperation between the two sides. These chapters emphasize the use of international standards, transparency, and consultation mechanisms to facilitate trade. Additionally, mandatory acceptance of certificates issued by EIC facilitates trade and help in avoiding unnecessary testing and inspection of India’s exports at the port of arrival in Oman.

| Enhanced harmonization of conformity assessment procedures in Priority Sectors

Pharmaceutical Products: Fast-tracking of marketing authorizations for products approved by USFDA, EMA, UK MHRA, and other stringent regulators, along with acceptance of GMP inspection documents, significantly reducing approval time and compliance costs for Indian exporters.

Halal and Organic Products: The agreement also provides for acceptance and recognition of halal certification systems and India’s National Programme for Organic Production (NPOP) certification, aimed at avoiding duplication of testing and certification requirements and facilitating market access for exporters.

|

Conclusion

The India–Oman CEPA establishes a comprehensive framework covering trade in goods and services, investment, professional mobility, and regulatory cooperation, while maintaining a balanced approach to market access and safeguards. The agreement is expected to boost bilateral trade, generate employment, strengthen supply chains, and support deeper and more sustained economic engagement between India and Oman.